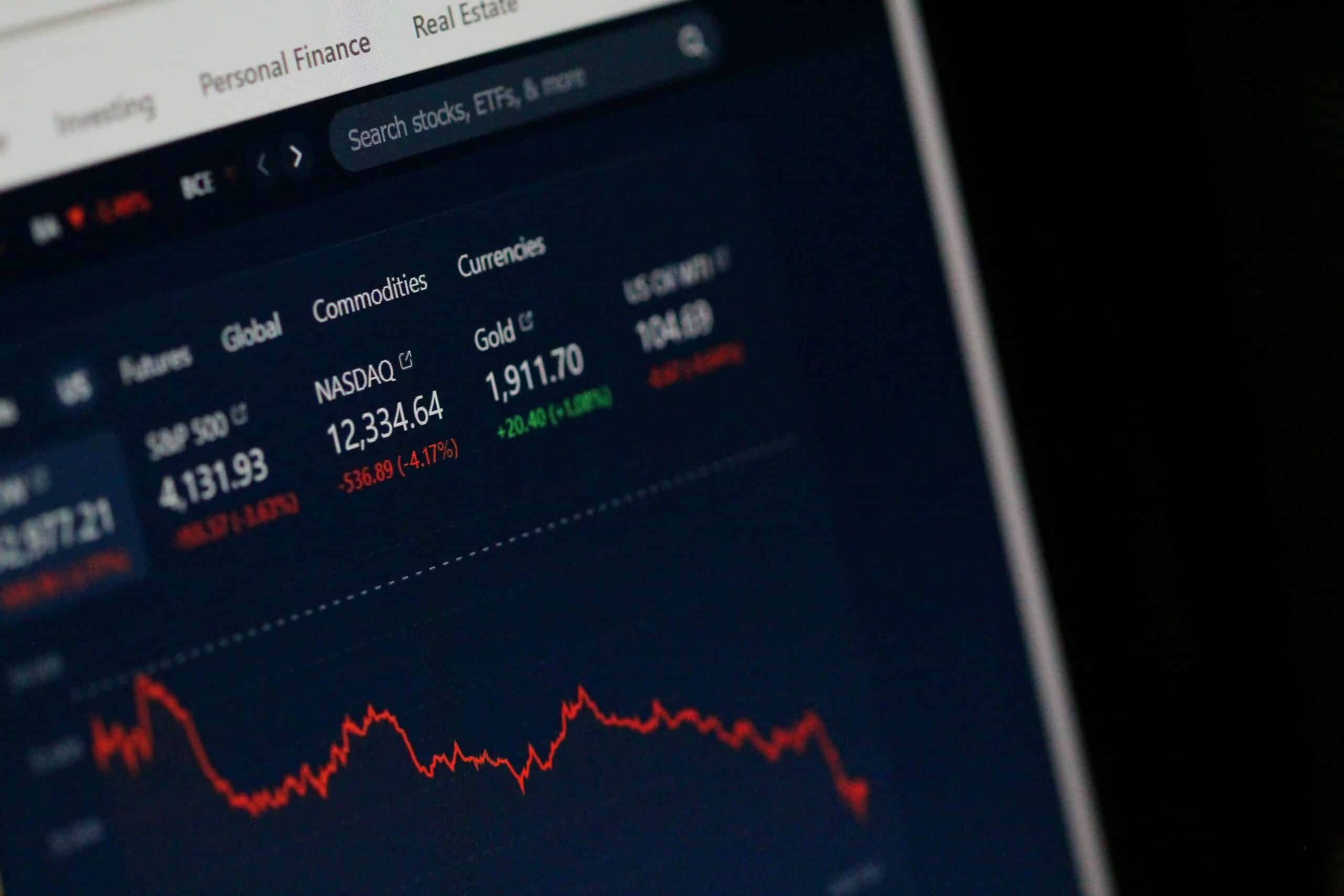

- The stock market had a mixed end to the week, with the Dow slightly up, the S&P slightly down, and the Nasdaq also down.

- Strong economic data led to some gains in bond yields earlier in the week, but those gains were mostly erased, causing tech stocks to underperform.

- Surprisingly, the value of the Dollar remains weak despite the positive data.

- Healthcare stocks performed well on Friday, driven by strong earnings from United Health. Consumer staples also did well, indicating a more defensive market sentiment.

- Homebuilder stocks reached all-time highs and are up significantly this year due to unexpectedly high demand for new homes.

- Energy stocks performed poorly, with oil prices down 2%. Other commodities were mostly unchanged, but there was some strength in soft commodities.

- Hollywood actors’ strike is impacting movie and streaming companies like Warner Bros Discovery, Paramount, Walt Disney, and Netflix.

- Labor unions are taking advantage of the tight job market and are likely to initiate more high-profile strikes.

- Burberry reported a 17% increase in revenues, mainly driven by strong growth in China.

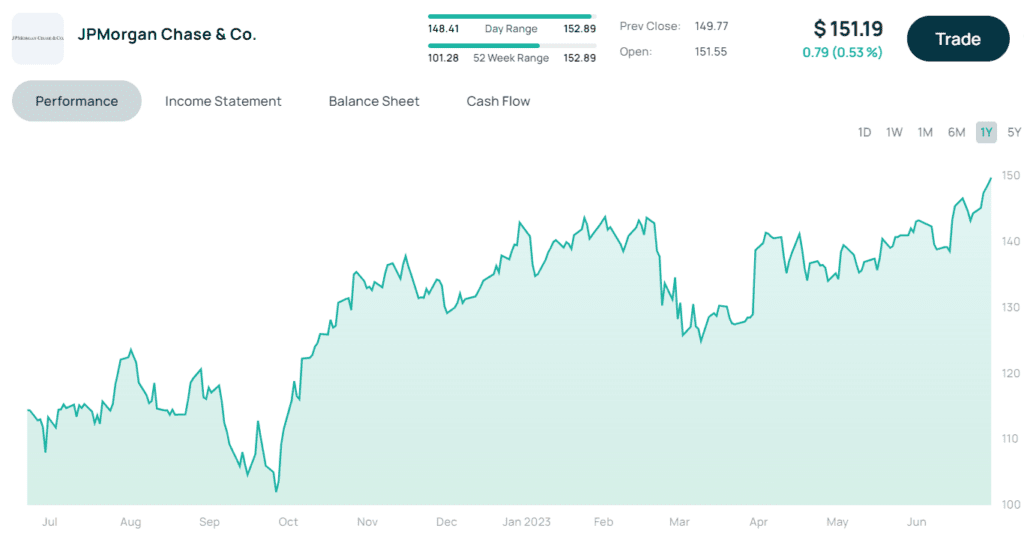

- JP Morgan had positive results, with strong net interest income, although investment banking revenues were down.

- Citi reported lower investment banking revenues and higher costs.

- State Street faced challenges retaining institutional clients, resulting in a significant stock drop.

- United Health, reported strong earnings and raised their guidance.

- Absa issued a trading update in line with expectations.

- Chinese economic data was underwhelming, with slow GDP growth, lower exports, and retail sales missing expectations. Commodities were affected, but equity markets remained resilient.