5 steps to master trading psychology

Beyond the technical analysis, fundamental research and strategy formulation, do-it-yourself (DIY) investors and traders must also master their emotions to execute their plan and avoid making rash or impulsive decisions that can increase losses or miss out on opportunities.

Trading psychology is defined as the emotional component of the investment decision-making process. The most prominent emotions that influence trading psychology are generally fear and greed, which often fuel irrational decisions on either the investment upside or downside.

For instance, greed often drives decisions that might increase risk as traders remain invested for too long before taking profits off the table. Fear also has a powerful influence on investment outcomes, creating doubt that brings into question a trader’s market read or stock pick, which could mean exiting a position before the trade can play out.

As such, the ability to manage your emotions and harness the tools necessary to maintain discipline by following these five tips is crucial to achieving consistent profits or managing losses when you choose to trade your way.

Devise a Trading Plan and Stick to It

Trading and investing without a plan will leave your decisions at the mercy of your emotions. This is why it is so important to define your financial objectives and risk tolerance upfront.

Identify the potential opportunities through your market and stock analysis and establish clear entry and exit points.

Most importantly, stick to the plan and don’t deviate from your strategy, even when your emotions run high if markets turn or run harder than expected.

Learn from Experts

Read books, listen to presentations, register for seminars or enrol in formal education through courses to learn from expert investors and traders to understand market psychology and identify common mistakes that DIY investors make.

Books and articles can provide in-depth knowledge about market history, theories, and current trends while attending seminars or listening to presentations can offer insights into key learnings and experiences that can accelerate learning for new investors.

Completing formal courses can give DIY traders the tools and skills needed to assess markets using a combination of technical analysis, fundamental analysis, and risk management to plan and execute considered trades and investment strategies.

Gaining a deeper understanding of market dynamics, financial instruments, and risk management strategies provides a solid foundation for rational decision-making. When traders are well-informed, they are less likely to panic or become overly excited in response to short-term fluctuations, mitigating the risk that they will make emotional decisions.

Understand Your Emotions and Triggers

Traders must understand how certain biases or emotions can affect their trading decisions and use this information to their advantage.

Gaining these insights starts with identifying triggers, which can include situations or events that evoke strong emotional responses, or understanding your attachment and relationship to money. After identifying your emotions and triggers, try to recognise patterns, noticing how your emotions affect your decision-making.

Pay attention to and note your thoughts and feelings when stock prices are rising or falling relative to your position. Acknowledge your emotions and interrogate them to understand what’s driving these feelings before making any decision that deviates from your established trading plan.

Keep Impulsivity in Check

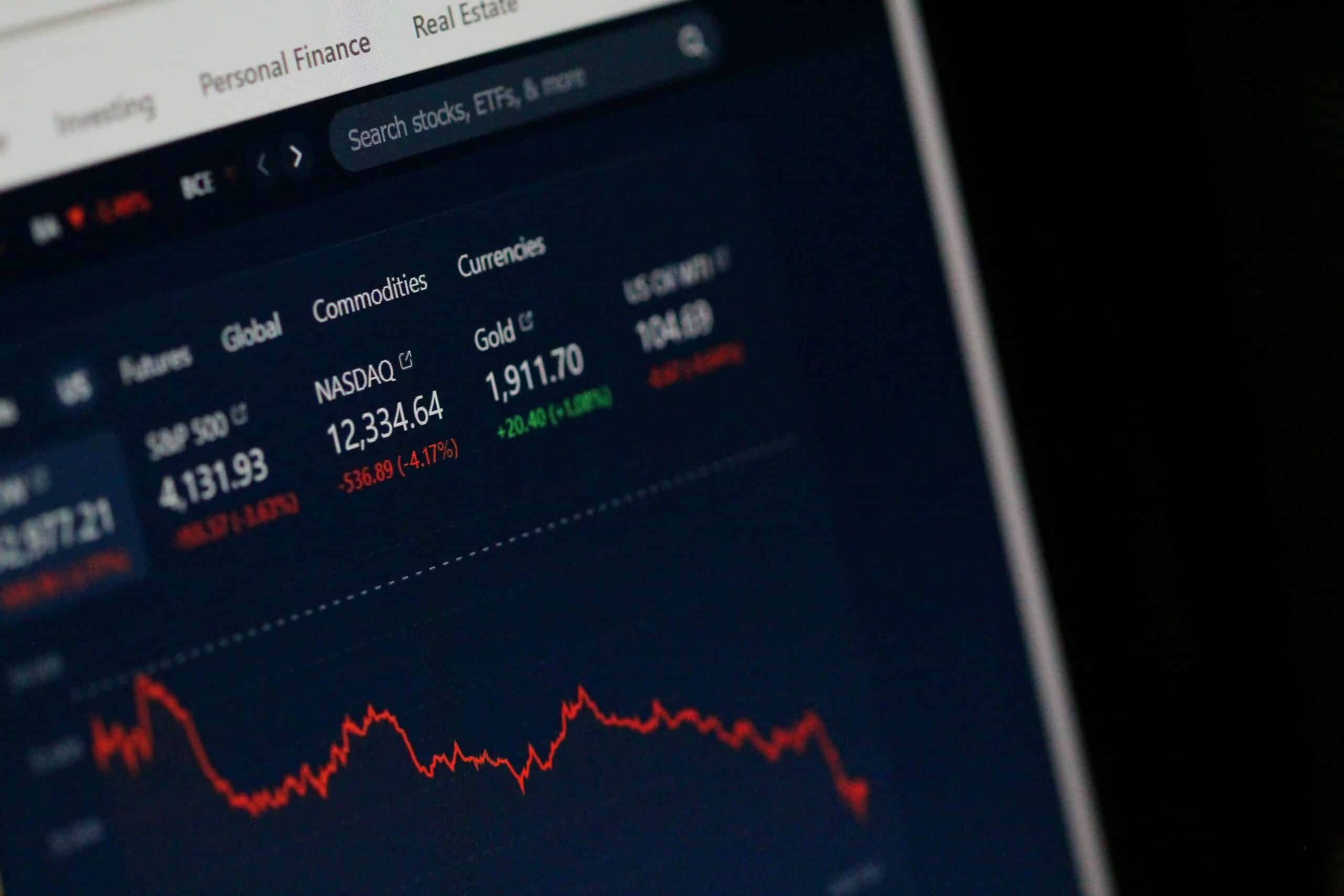

Markets and stocks can experience volatile intraday movements, rising into positive territory and falling into the red (a loss) for multiple reasons.

It is vital that traders resist the urge to react to every market movement and avoid making impulsive decisions that go against the established trading plan or strategy. It is important to trust your research and analysis and practice patience to develop the ability to wait for the identified opportunities to unfold.

Traders need strong conviction to remain invested when markets hit unexpected volatility or stocks experience fluctuations.

Traders need to adhere to the strategy and stick to their defined entry and exit points by keeping their emotions out of the decision-making process to avoid mistakes like averaging down by adding to a losing position, hoping the price will rebound.

Ultimately, the critical success factor in any risk mitigation strategy is meticulously planning every trade and then trading the plan. This requires a level of detachment that views trading as a business, not a gamble.

Learn from Mistakes

When you experience a loss, view it as a learning opportunity. Analyse your mistake to understand what went wrong and identify the factors that led to the loss. Use these insights to improve your skills and avoid making the same mistakes in future trades or investment decisions.

And don’t dwell on the past. Maintain a positive mindset by focusing on the present and future, using the loss as a stepping stone to success.

Ultimately, becoming a master of trading psychology is a continuous process. It requires ongoing effort and self-awareness. By understanding your emotions, developing a solid trading plan, and managing fear and greed, you can improve your chances of earning your share of the market.