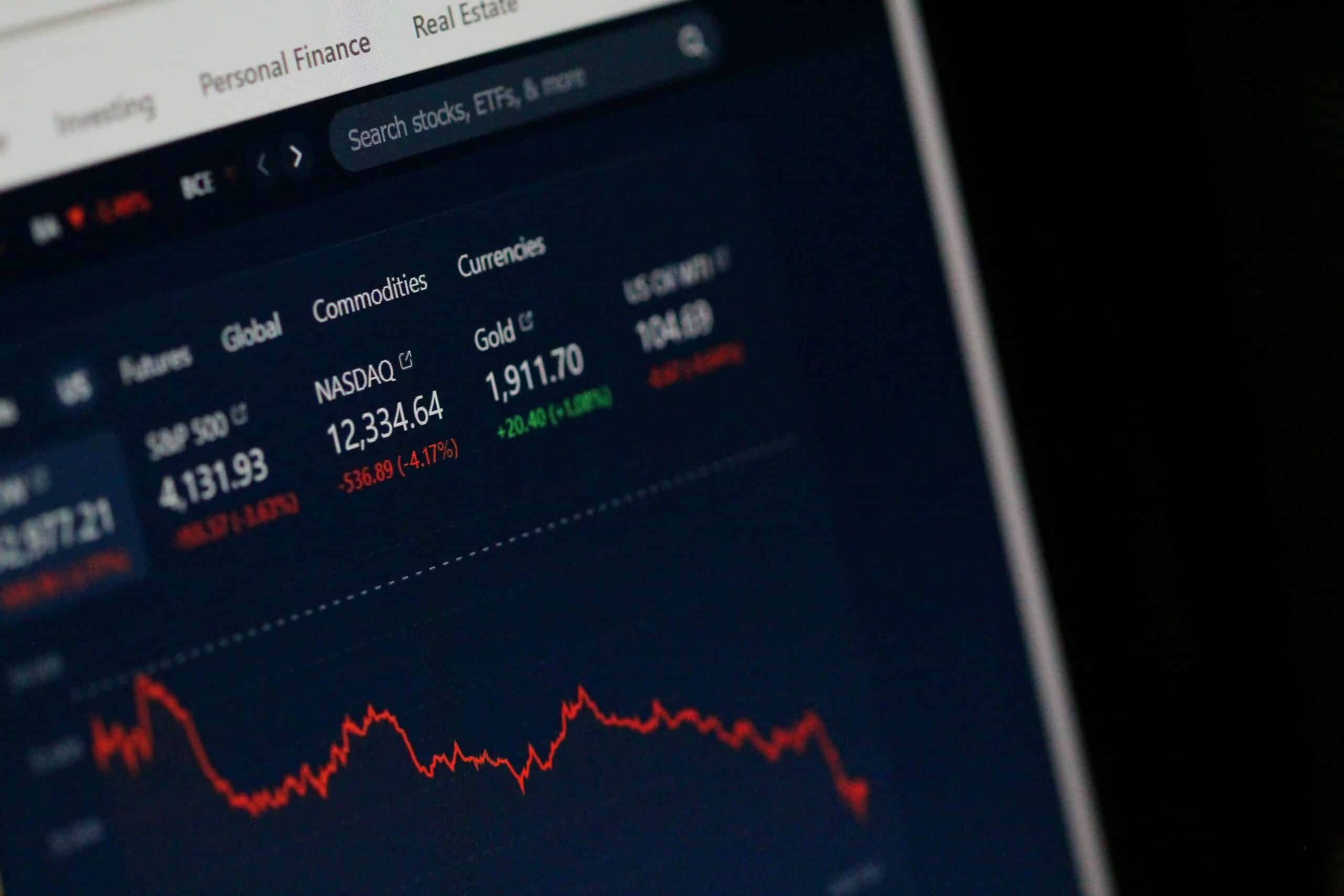

- Market remains steady with ongoing debates on the debt ceiling and recession concerns.

- Yields are rising, but the technology sector continues to outperform, while consumer discretionary stocks struggle.

- Regional banks receive a boost (3.2%) as Pacwest sells loans to improve liquidity, increasing investor confidence.

- Micron (-3%), Footlocker (-8.5%), and Nike (-4%) stocks decline due to factors like Chinese bans.

- Globally, Ryanair (+1.3%) predicts strong summer demand, Zoom (+1.2% after hours) focuses on contract renewals, and Redfin reports a significant drop in US home sale prices.

- Premier Foods’ results align with expectations, showing strong sales and growth.

- SARB rate decision approaches with limited options to combat inflation, expected to see a modest increase.

- Asian futures show mixed results, Nikkei takes a break, and concerns arise about China’s demand impacting iron ore futures.

- US futures respond positively to constructive debt ceiling discussions.

- Some investors anticipate a potential market rally in the near future, defying expectations.