- Market themes from Thursday unraveled on Friday as the government payrolls print tempered the excitement following the strong ADP employment data.

- Yield curve rallied on hopes of fewer rate hikes, but wage inflation picked up, indicating little change in the overall economic picture.

- Equity markets started strong but lost momentum towards the end of close. As we approach the end of the interest rate cycle, it may be wise to consider a shift towards old-world cyclicals for investment opportunities.

- Energy, Materials, and Industrials sectors showed strength, while defensive sectors like staples, healthcare, and utilities faced declines.

- Alibaba ADR surged 8% following regulatory fines, indicating a potential end to a challenging regulatory period. Tencent ADR also rose 4%.

- Levi Strauss shares dropped 7.7% after the company lowered its full-year guidance due to weak US wholesale business and price-sensitive shoppers.

- Biogen received full FDA approval for their Alzheimer’s drug, but the market was disappointed due to lingering concerns about side effects and efficacy.

- Coca-Cola Hellenic significantly upgraded its FY23 guidance after a strong June, benefiting from exposure to tourist destination markets. Last Thursday marked the busiest ever day for commercial flights, indicating a recovering travel industry.

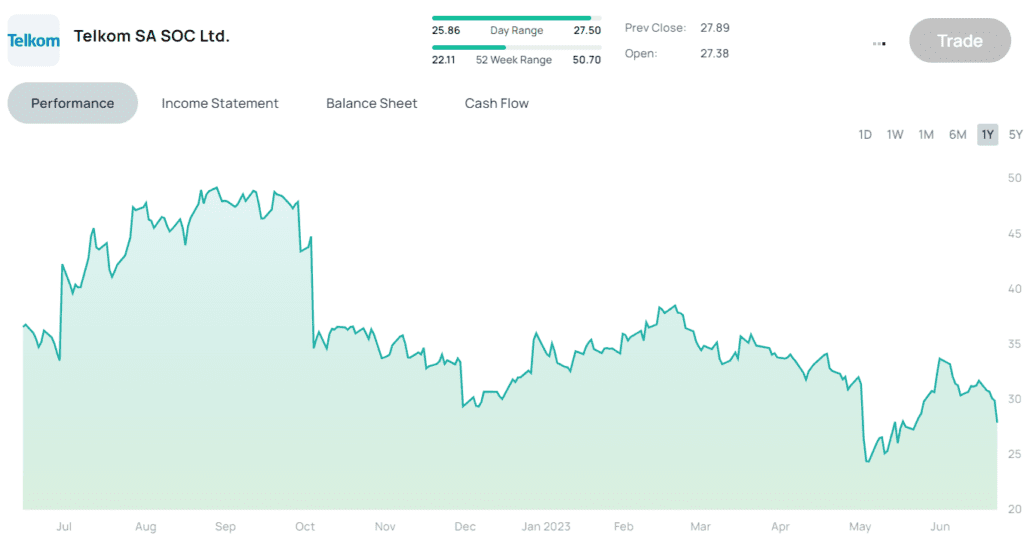

- Locally, Telkom shares declined 6.7% as discussions with Sipho Maseko’s consortium ended.

- China’s CPI at 0% suggests struggling demand, while PPI at -5.4% indicates deflationary export from the world’s factory. Calls for further stimulus may arise.

- Commodity futures show little enthusiasm, with iron ore down nearly 3%

- Keep an eye on the upcoming US earnings season and the US CPI print for potential market impact.