Self-directed investors who want to get their share of the market, and a share of the success of the companies they invest in, should consider including high-yield dividend stocks in their portfolios.

A company pays dividends to its shareholders when it chooses to distribute a portion of its after-tax profits, rather than reinvest those earnings back into the business.

Companies choose to pay dividends for various reasons, often to reward shareholders for investing in the company.

Paying dividends is also a popular way for companies to attract new investors, with dividend yield – the annual dividend payment per share divided by the stock price – a popular metric to determine a company’s financial health and stability.

Either way, a diversified portfolio that includes a selection of dividend stocks can produce a regular and reliable income stream for DIY investors who want more than just capital growth.

Understanding Dividend Payments

Listed companies that choose to pay a dividend most commonly do so in the form of cash, either quarterly, bi-annually or annually.

However, the dividend amount typically varies from quarter to quarter, with any increase or decrease in dividend payments related to the company’s financial performance.

The dividend amount is usually expressed as an amount of money per share. For example, if a company declares a dividend of R0.50 per share, and you own 100 shares of that company’s stock, you would receive a dividend payment of R50.

Companies can also issue additional shares of stock as a dividend, while special dividends are one-time payments that do not form part of a regular dividend schedule.

Dividend payments follow a set structure, which includes three important dates:

- Declaration date: The date on which a company declares a dividend.

- Record date: The date on which you must be a shareholder of the company to receive the dividend.

- Payment date: The date on which the dividend is paid out to shareholders.

Tax Implications of Dividends

Dividends are considered taxable income, just like any other form of investment income. However, the tax rate on dividends is usually lower than the tax rate on ordinary income.

In South Africa, dividends paid by local and international companies listed on the Johannesburg Stock Exchange (JSE) are taxed at a rate of 20%.

Known as the Dividend Withholding Tax (DWT), the South African Revenue Service (SARS) will take its 20% share before the balance of 80% is paid to shareholders, whether they are natural persons, trusts or foreign investors.

Selecting Dividend Stocks

Companies that pay dividends are generally more established and financially stable, which can make their stocks less volatile than those of companies that do not pay dividends.

However, before investing in a company that pays dividends, it is important to conduct research and understand important metrics and company policies.

In addition to providing a snapshot of the potential income investors can expect from a stock, dividend yields allow investors to compare the dividend payouts of different companies, even if their share prices are different.

Some investors use the metric to assess whether a stock is over- or undervalued. For instance, a significantly higher yield than the industry average may suggest the stock is undervalued, but it could also be a red flag.

The percentage of earnings paid out as dividends, known as the payout ratio, is another important metric to consider. A high payout ratio may indicate that the company is not reinvesting enough back into its business, which can limit research and development and innovation.

A good example is Boeing (BA-NASQ), which consistently paid handsome dividends to the detriment of business operations.

The other important metric to consider is dividend history. Companies that have a long history of paying dividends and increasing their payouts over time tend to sustain the practice.

However, it is important to note that dividends are never guaranteed, even if a company is widely considered a dividend-paying stock. Companies can choose to suspend or eliminate their dividend payments at any time.

Investing in Dividend Stocks

Overall, dividend-paying stocks can be a valuable addition to any investment portfolio. They offer the potential for income and capital appreciation, along with portfolio diversification benefits to reduce overall risk.

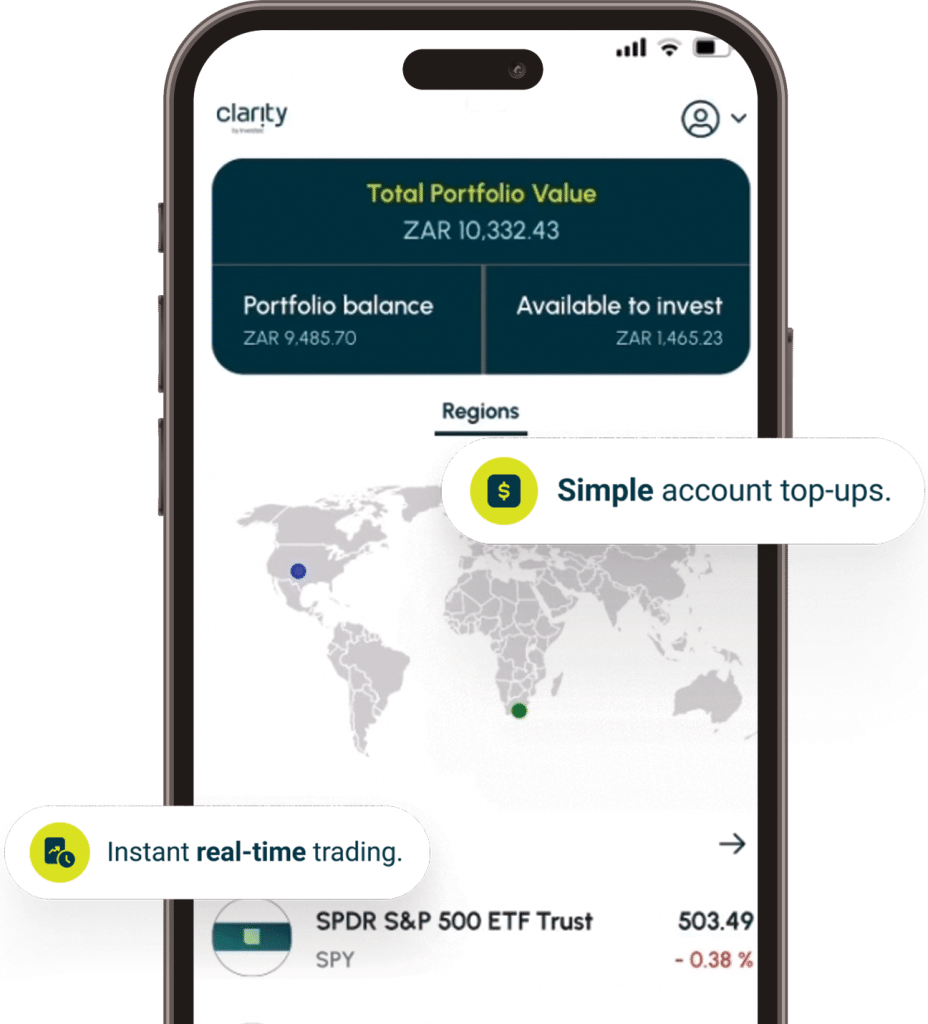

DIY investors can invest directly in high-yielding dividend stocks via the Clarity, by Investec platform. Some JSE dividend stalwarts include a mix of resource, financial services and banking, and consumer goods stocks, such as:

- Exxaro Resources (EXX-JSE)

- Kumba Iron Ore (KIO-JSE)

- BHP Group (BHG-JSE)

- Nedbank (NED-JSE)

- Absa Group (ABG-JSE)

- Standard Bank (SBK-JSE)

- Old Mutual (OMU-JSE)

- British American Tobacco (BTI-JSE)

- AVI Limited (AVI-JSE)

DIY investors who want to maximise yield within an equity investment strategy can also use an index to gain broader exposure to a mix of South African dividend-paying companies.

For example, the Satrix Divi Plus ETF (STXDIV-JSE) consists of 30 companies expected to pay the best normal dividends over the forthcoming year.

The selection is not based on the market capitalisation of the shares but rather on the company’s ability to pay superior dividends. This ETF will have a low correlation with other indices on the JSE and is, for this reason, an ideal product for diversifying investment portfolios.

After receiving dividends, astute investors often choose to reinvest dividends back into the company’s stock, which can help to accelerate returns over time through the power of compounding or invest the cash into higher-risk, high-growth stocks to potentially earn a higher return.