Unit trusts are popular collective investment schemes (CIS) that offer investors numerous benefits.

Unit trusts are a type of mutual fund comprised of a collection of assets. They are managed by professional fund managers with specific mandates characterised by their risk profile.

In South Africa, unit trusts are governed and managed according to the Collective Investment Schemes Control Act. They distribute profits to investors instead of reinvesting them into the fund, offering an attractive and accessible investment vehicle well-suited to a range of investment goals, whether growing or preserving your capital.

How Do Unit Trusts Work?

A professional fund manager selects assets, such as shares, bonds, property, cash, or a combination, and then buys the assets on behalf of the fund.

The fund is split into equal units and sold to investors, who can select the most appropriate options to achieve their financial goals.

Unit Trust Benefits

Due to the regulated nature of unit trusts, coupled with transparent pricing and performance, these investments offer investors an element of trust and safety.

This transparency and professional management mean DIY investors do not need to conduct the extensive due diligence into the underlying structure, custodianship and administration often required when investing in other investments.

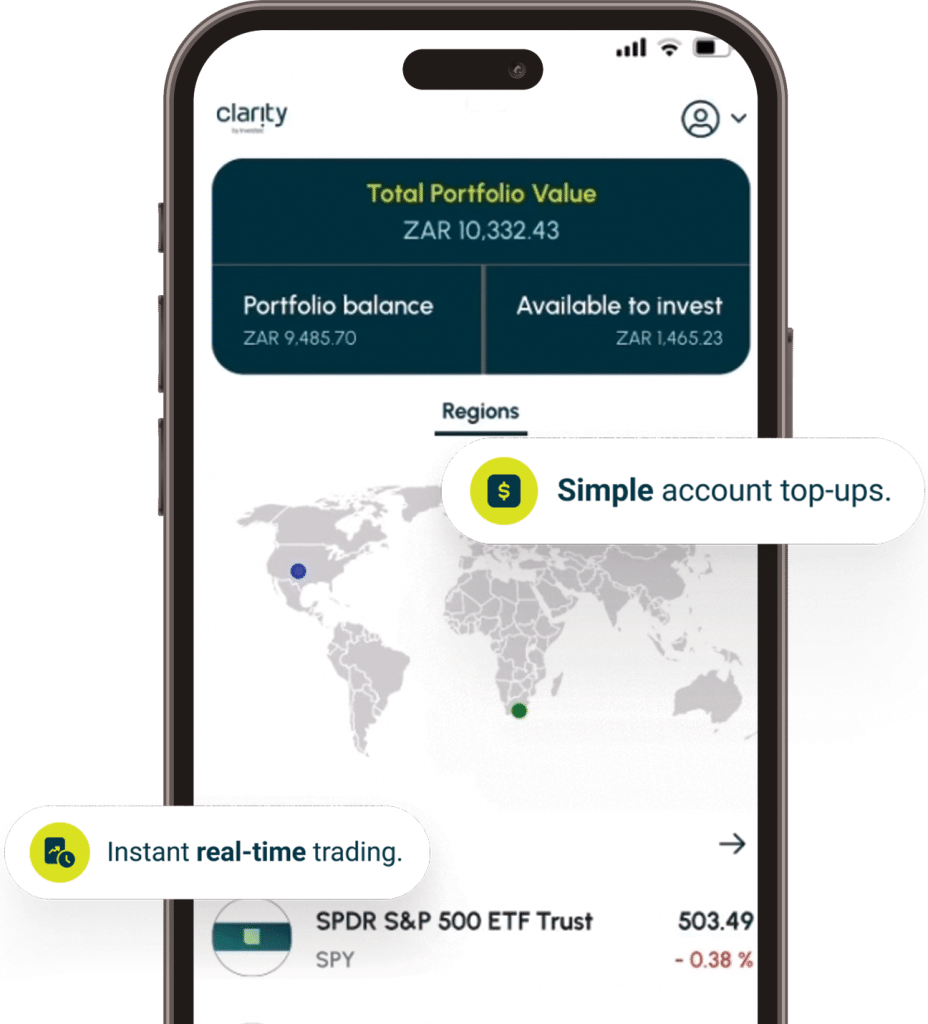

Another important benefit is the low barrier to entry as unit trusts have low minimums, are cost-effective, and are easily accessible via online trading platforms.

These features offer investors an efficient entry point to a broad range of assets and financial markets, both locally and globally.

The baked-in diversification offered by unit trusts can help manage risk while the ability to buy and sell units as required offers flexibility and agility.

Unit trusts also offer certain tax efficiencies because, when the fund manager buys or sells securities (known as rebalancing) within the portfolio, it does not trigger a tax event for the unit holder. Investors only become liable for capital gains tax when they sell out of the unit trust.

However, a unit trust may still receive distribution income, which could include dividends and interest. Local dividends would be subject to dividends tax and other distribution types would be subject to income tax.

Types of Unit Trusts

Unit trusts offer investors access to a broad range of asset classes and different geographies. These features allow investors to spread risk across a broad portfolio of instruments and offer an effective tool to achieve different outcomes and express various investment views and strategies.

Tier one funds either focus their investments locally or globally, whereas a worldwide unit trust fund can switch between South African and global markets without limitation.

No matter where you choose to invest, each of these funds will follow a specific theme. The main unit trust options include:

Balanced Funds

Balanced funds are a “jack-of-all-trades”, offering a mix of stocks for growth potential and bonds for stability and some income. Basically, these unit trusts offer baked-in diversification, ideal for the risk-averse investor.

Multi-Asset Funds

Multi-asset funds invest in more than one asset class. While similar to a balanced fund, multi-asset funds typically encompass a broader range of asset classes, like shares, bonds, cash, listed property or commodities, depending on the fund’s strategy.

Money Market Funds

For investors looking to hold cash and potentially earn a bit more than the interest offered from a regular savings account, money market funds offer a low-risk option. While investors won’t shoot the lights out with their returns, these funds are a good place to keep short-term savings to remain liquid while looking for other potential market opportunities.

Income Funds

Investors looking for regular payouts can invest in an income fund. Also known as an interest-bearing fund, these funds invest in income-generating instruments like bonds, fixed deposits, dividend-paying stocks, preferred stocks, and Real Estate Investment Trusts (REITs). These features make these funds attractive to investors who want a steady income stream, such as retirees or those looking to supplement their current earnings.

Stable Funds

Stable funds are all about keeping your money safe and sound. They invest in low-risk investments like government bonds and quality corporate bonds. While the returns aren’t spectacular, they are usually steady and reliable.

Growth Funds

For investors with a bigger risk appetite, growth funds (also called capital or capital appreciation funds) focus on growing your money over the long term by investing in stocks, real estate, and other growth-oriented investments. However, the hunt for higher growth and better returns typically comes with higher risks.

Inflation Funds

Investors looking to protect their capital against the erosive impact of inflation can invest in an inflation fund. These fund manager aims to stay ahead of the inflation curve by investing in assets that tend to hold their value, especially during periods of higher inflation. These investments include inflation-linked bonds, REITs, and commodities like gold.

Property Funds

Property funds give investors exposure to the real estate market without having to buy a physical building. These funds invest in a range of properties across the commercial and residential markets, including office buildings, logistics centres, shopping malls, and apartments.

Equity Funds

Investors who want to go all in on stocks can easily invest in a wide range of companies or gain exposure to specific sectors by accessing an equity fund. These funds are another higher-risk option but offer better potential for returns in the right environment.

Fund of Funds

A fund of funds pools investment capital into a wider portfolio of several investment funds instead of directly investing in single stocks or one type of unit trust fund. A fund of funds can offer diversification, professional management, and broad market exposure, which makes it a good option for novice investors.

Feeder Funds

Instead of investing directly in stocks or bonds, feeder funds invest in another fund, usually a bigger “master fund”. International feeder funds are an effective and cost-efficient way to boost offshore exposure without utilising your annual direct investment allowances.

Picking a Unit Trust Fund

With so many options available, your choice of unit trust funds will depend on your personal circumstances, investment horizon and risk profile.