The International Monetary Fund (IMF) released its latest World Economic Outlook Update in January.

The organisation, which is tasked with promoting global economic growth and financial stability, expects the global economy to grow 3.3% in 2025 and 2026, which is below the historical (2000–19) average of 3.7%.

Various factors are playing into this potential slowdown in global growth, with many potential economic speedbumps on the horizon. Currently, the trade tariffs promised by the new Trump administration are the biggest risk to global growth in the year ahead.

What are cyclical stocks?

Cyclical stocks are shares influenced by major changes in the local or global economy and are subject to price fluctuations that echo the broader economic cycle.

These stocks are generally sensitive to changes in economic indicators such as GDP growth, consumer confidence, and interest rates.

As economic cycles go through ups and downs, you get different types of cyclical stocks:

- Pro-cyclical stocks thrive during economic expansions but struggle during recessions.

- Counter-cyclical stocks tend to perform better when the economy is weak and underperform during economic booms.

Go with the growth

Pro-cyclical stocks perform well during periods of economic growth because demand for a listed company’s products or services increases as more people are employed and salaries rise above inflation, which is usually low.

This environment, known as economic expansion, leads to higher sales and profits, and consequently, rising stock prices.

When the cycle turns and an economy enters a recession (an economic contraction) or period of stagflation (high inflation and low growth), demand falls, leading to lower sales and profits, and stock prices typically decline.

Examples of pro-cyclical stocks include consumer discretionary stocks – think automotive manufacturers, such as General Motors (GM-NASQ) and luxury goods brands, such as Compagnie Financiere Richemont SA (CFRZ-TRQX) – industrial stocks in the construction sector, like Aveng (AEG-JSE), and mining companies, like Anglo American (AALL-TRQX).

Counter-cyclical stocks

As counter-cyclical stocks tend to perform better during economic downturns, recessions and periods of high inflation and rising interest rates, they offer a valuable hedge against market volatility by moving in the opposite direction of the broader economy.

When the economy is struggling, consumer spending often declines, benefiting companies that provide essential goods and services. These businesses are typically considered defensive, meaning they are less vulnerable to economic downturns.

These stocks include consumer staples – food producers like Nestle (NESNZ-TRQX) and Procter & Gamble (PG-NASQ) and retailers like Boxer (BOX-JSE) and Shoprite (SHP-JSE) – and utilities like Dominion Energy (D-NASQ).

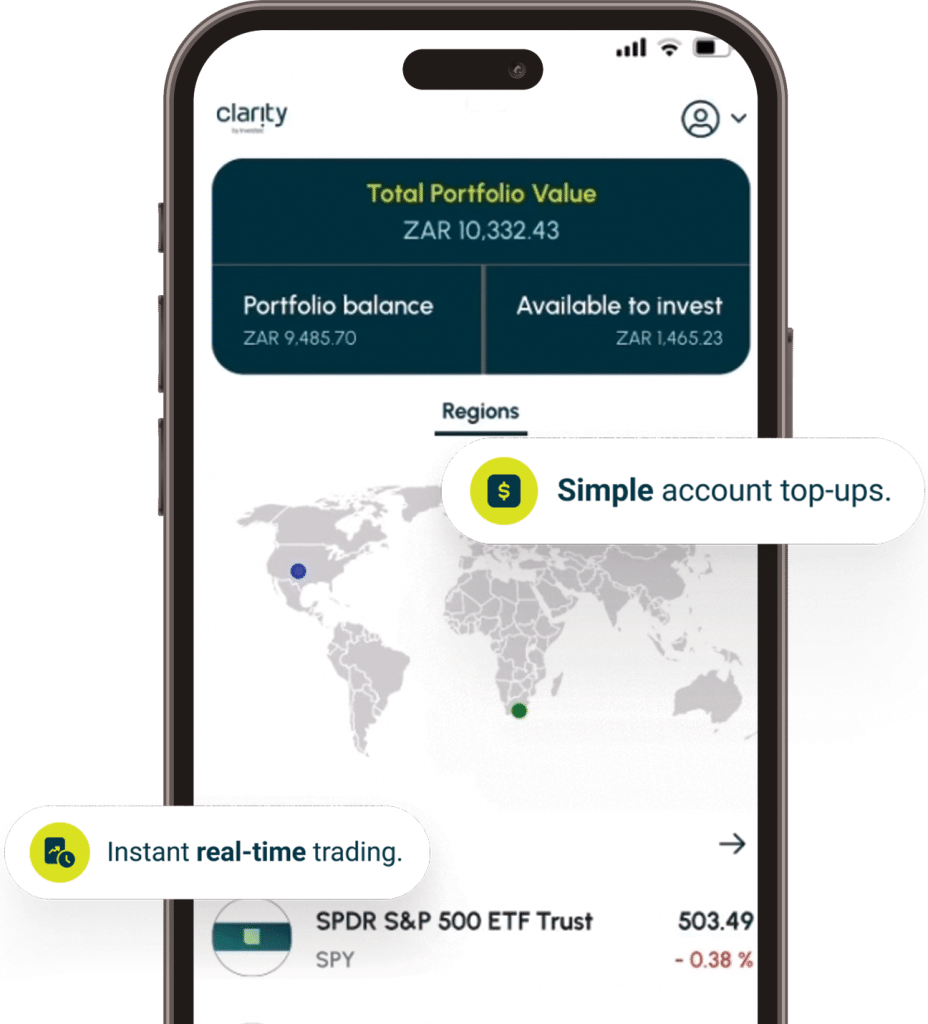

Investing in cyclical stocks

Investing in pro-cyclical stocks can deliver above-average returns during periods of economic expansion.

Self-directed investors should aim to buy pro-cyclical stocks during the early stages of an economic recovery to catch more of the potential upside and sell them before the peak of the cycle.

The risks associated with holding pro-cyclical stocks increase when the economic cycle turns and economies enter periods of low growth or a recession.

Shifting to counter-cyclical stocks at this point can create opportunities to continue earning returns during an economic downturn, which offers portfolio protection benefits.

Due to their nature, both types of cyclical stocks are important for do-it-yourself (DIY) to consider in the context of the broader economic cycle. They can offer diversification benefits when included within a broader investment strategy, but it is crucial to understand the risks associated with these stocks and develop a plan before investing in them.