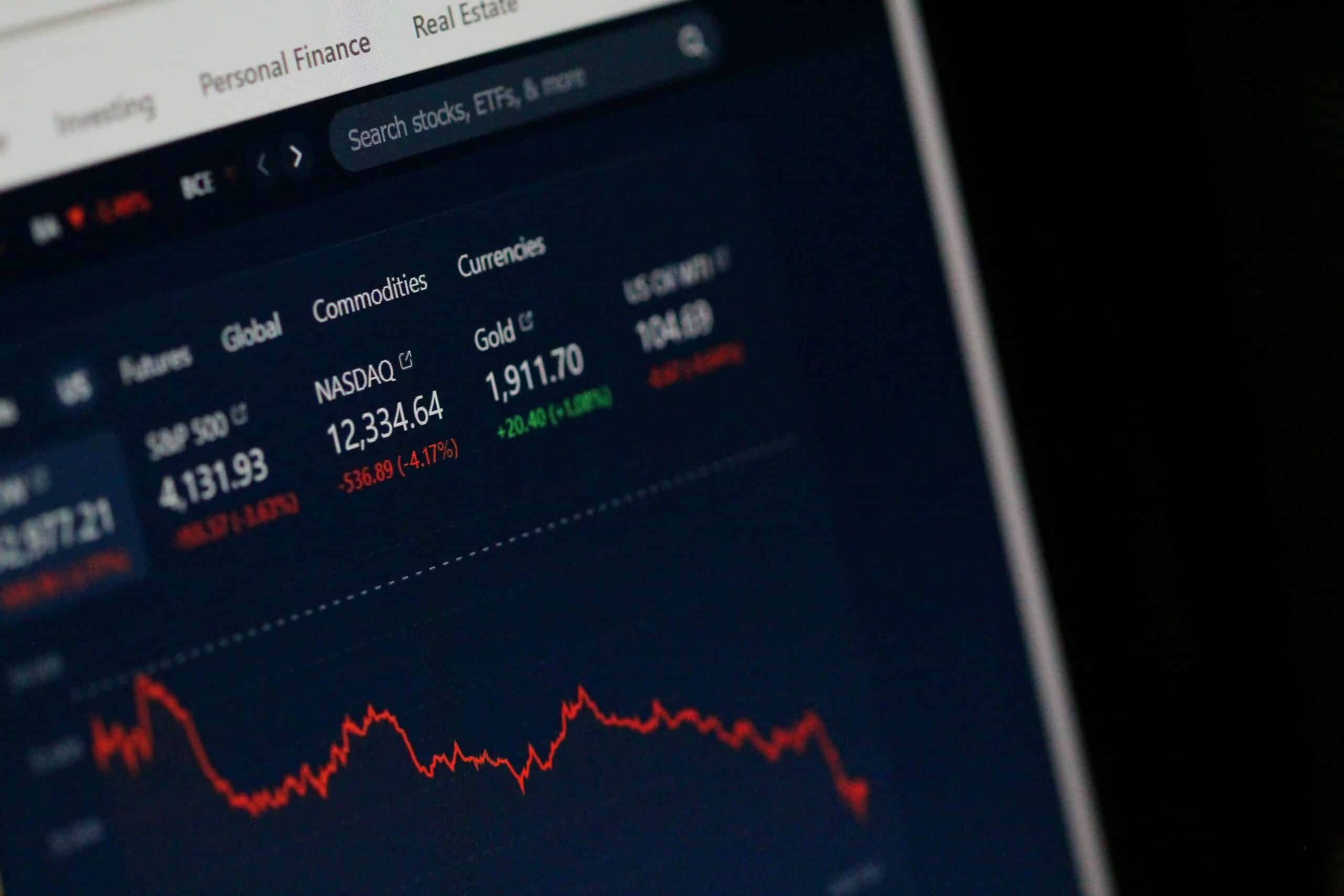

Europe is falling further behind the dominant US as a developed market of choice for global investors. The 20-country eurozone finds itself in a difficult position with economic indicators continuing to point to a loss of momentum while the recovery in the UK remains slow and complicated. Global investors must consider numerous factors when allocating to developed markets in 2025.

UK consumers more upbeat

According to a Bloomberg report, consumer sentiment in the UK is rising. The RICS house price indicator hit its highest in more than two years in November as buyers were buoyed by a Bank of England (BOE) rate cut and an end to uncertainty over Labour’s first budget. New proposals to lower UK energy bills will also see power customers pay nothing or significantly less to connect to the grid. Energy regulator Ofgem wants standing charges, fixed costs added on top of bills to cover grid connection, to be scrapped or lowered for some customers as it addresses record public debt. The charges have almost doubled since 2019, accounting for about 20% of customer bills.

Eurozone 2025 outlook

Investec analysts downgraded their eurozone GDP forecast to 1.2% from 1.5% as the 20-country bloc finds itself in a difficult position with economic indicators continuing to point to a loss of momentum. Manufacturing remains weak, while conditions are softening elsewhere too. Political problems in France and Germany look set to further cloud the outlook for 2025. This is before the implications of the new US administration are taken into account. Our GDP forecast for 2024 is unchanged whilst 2025 is, a reflection of both the recent data and a US tariff impact. Regarding monetary policy, Investec assessments suggest that the balance of data argues for a more aggressive ECB policy approach and expects the deposit rate at 1.50% by the end of 2025.

United Kingdom 2025 outlook

According to Investec analysts are factoring in some impact on the UK from a US ‘universal tariff’, but this may be fairly muted as British goods exports to the US account for just 2.3% of GDP. Inflation is expected to rise close to 3.0% by mid-2025, partly on utility prices, but seems likely to fall close to 2.0% by year-end as services inflation continues to moderate. The outlook suggests continued gradual policy loosening, with the Bank rate expected to fall by a further 100bps to 3.75% by end-2025. GDP growth has lost momentum recently, but firm household income growth should support spending in future.

ECB Cuts for Third Straight Time to Prop Up Flagging Economy

The European Central Bank (ECB) lowered interest rates for a third consecutive meeting and signalled more reductions next year as inflation nears 2% and the economy struggles. The deposit rate was cut by a quarter-point to 3%. Indicating its shifting stance, the ECB’s statement dropped wording saying the policy will remain “sufficiently restrictive” for as long as necessary. Bloomberg reported that ECB policymakers expect to lower rates by another quarter point in January and probably also in March as inflation stabilises and growth remains sluggish.

Swiss stocks gain after surprise SNB cut

The Swiss National Bank (SNB) delivered a bigger-than-expected 50bps interest-rate cut as it sought to head off gains in its currency. The Swiss franc fell, pulling further away from a near-decade high hit against the euro last month and helped lift globally-exposed names in the Swiss Market Index (SMI).

LVMH deepens expansion into hospitality

LVMH Moët Hennessy Louis Vuitton SE (MCP-TRQX) has extended its bet on luxury hospitality in a deal with Fontenille, a small but high-end French hotel group with properties in tourist hot spots like Tuscany and Minorca. The deal marks the company’s latest expansion in the world of luxury travel, with a stake of about 20% in Les Domaines de Fontenille, according to Bloomberg.

SA makes strides towards private-public grid development

More than a year after Dr Kgosientsho Ramokgopa, then minister of electricity, held an investor conference about private sector participation in developing the country’s electricity grid, a Request for Information (RFI) was published on 11 December. This is the first step towards procurement, which was envisaged to start in the first quarter of next year. The closing date for the RFI is, however, only in February, which casts doubt on whether the timeline for the Request for Proposals (RFP) will be met. Bloomberg reports that the South African Independent Power Producer Association (Saippa) welcomed the RFI as a crucial first step to unlocking private capital towards expanding essential grid infrastructure. Grid expansion and reconfiguration have become a top priority to enable the development of a myriad of renewable energy projects by government and private sector players.

Sector focus: Mining and manufacturing

While business and consumer confidence are up in South Africa, certain critical sectors like mining and manufacturing are struggling as logistical constraints continue to impede activity. Mining production eased to 1.4% y/y at the start of the fourth quarter, following September’s 4.9% y/y revised lift. However, PGMs had the largest positive contribution to the headline reading. Production of PGMs rose by 3.3% y/y in October and, owing to its substantial size in the mining basket (30.16%), it added 1.0%.