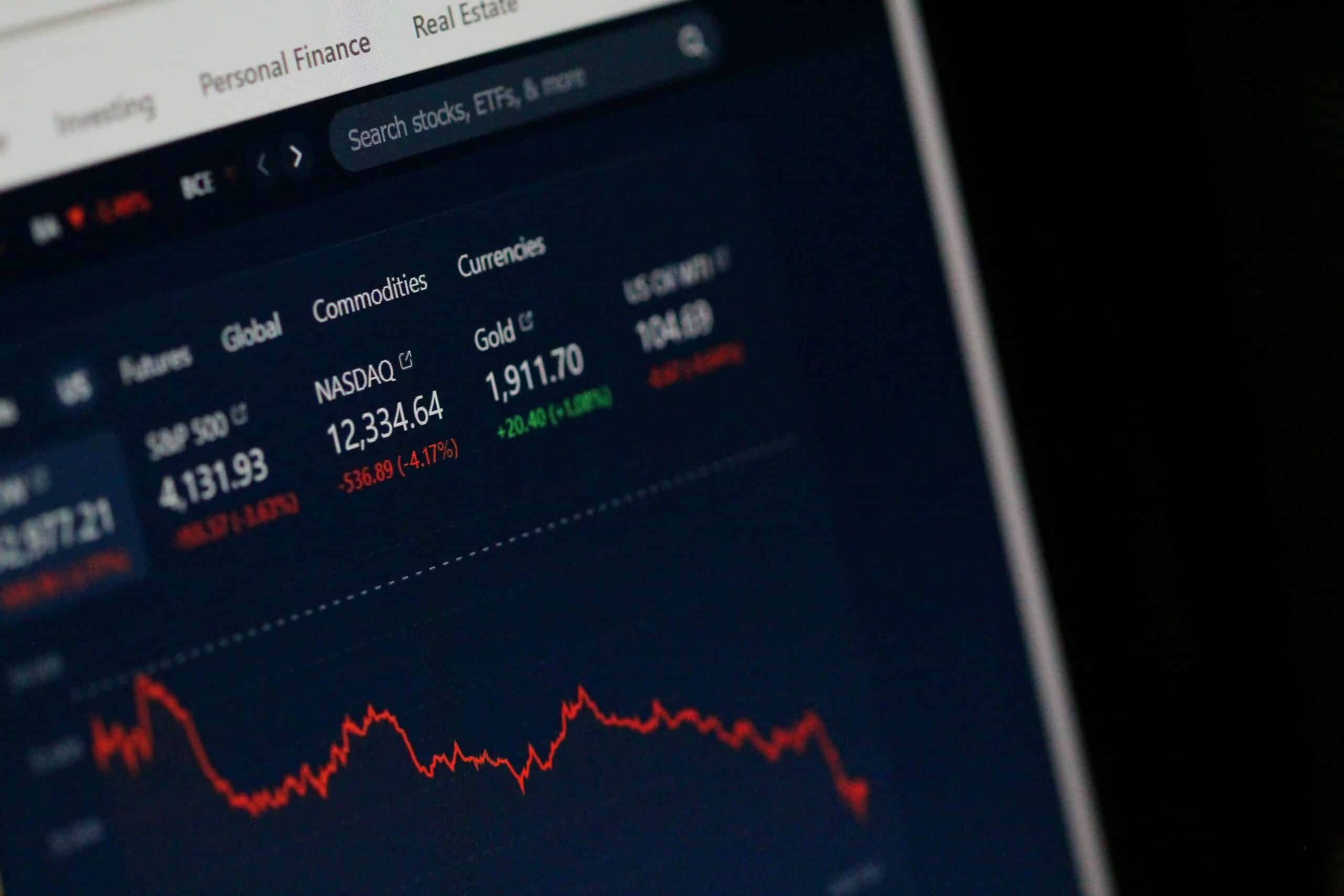

Markets and stock prices move up and down (or sideways) for numerous reasons and often follow this trend for a sustained period, which creates opportunities for traders to exploit the market or stock momentum.

Find out how you can get your share of the markets by understanding and leveraging market momentum as part of your trading strategy…

Market momentum defined

Market momentum is a technical analysis concept that can provide a valuable trading signal. It suggests a stock price will continue moving in the trending direction, sustaining the momentum in either an upward or downward direction for some time into the future.

Positive momentum can indicate a potential bullish trend while negative momentum can indicate a bearish trend. Traders and investors can track and measure momentum across asset classes and individual stocks, with market momentum referring to the overall market trend.

Trading the momentum

Momentum trading is a strategy that aims to capitalise on the momentum to enter a trend at favourable prices as it gathers pace and ride the trend for potential gains.

The goal is to buy into the broader market, specific sectors or individual stocks when prices rise and sell after the momentum peaks.

Conversely, when a market is in a clear downward trend, positioning for a short trade offers a viable strategy.

Traders can confirm market or asset movements and their direction by changes in trading volumes and by using one of several technical indicators to confirm the trend.

These technical indicators include candlestick charts, moving averages convergence divergence (MACD) and relative strength index (RSI). These indicators measure the speed and strength of price movements and can help identify momentum trends (more on these in a subsequent post).

Once a trader identifies an acceleration or deceleration trend in a stock’s price based on earnings or revenue reports or a broader market trend, they take a long or short position in the stock to profit from the potential continued momentum in either direction. However, these price trends are never guaranteed in the future.

This strategy relies on short-term movements in a stock’s price that is influenced by herd mentality, rather than any fundamental value in the stock or market.

Factors that drive momentum

Numerous factors can influence the direction and pace of market and stock momentum, with buying or selling volumes the key indicator supporting market movements.

For example, broad market increases in corporate profits can help to create positive price momentum in specific sectors as more traders and investors buy into a stock or sector.

Positive or negative news about a company or the broader market can also have a significant impact on momentum. For example, a strong earnings report or positive economic data can fuel a rally while negative news can trigger a sell-off.

Managing risk on momentum trades

While momentum trading can deliver trading profits, it is critical to manage your risks as market momentum trends can reverse suddenly, which can lead to significant losses without the appropriate protections in place.

Moreover, momentum strategies may be less effective during periods of market volatility or uncertainty.

Position sizing for risk management is critical because relying solely on momentum as a trading strategy carries significant risks. Only allocate a portion of your trading capital to the trade as part of a diversified portfolio based on your risk tolerance and the potential reward.

It is also crucial to conduct a thorough fundamental analysis to assess a company’s long-term prospects before positioning momentum trades in individual company stocks.

Ultimately, market momentum can serve as a useful tool for traders and investors when you understand its principles and limitations, and use it as part of a broader, more diversified trading strategy.

By combining momentum analysis with other factors, like fundamental analysis and risk management measures, investors can make more informed decisions and potentially improve their investment outcomes when engaging in momentum trading.